Navigating the Transformed Accounting Landscape

The accounting industry is changing. It's no longer just about crunching numbers. Today's accountants are becoming trusted advisors, combining their financial knowledge with tech skills. This shift has a big impact on how you should find an accountant.

Businesses today want proactive advice, not just reports on what's already happened. This means the ideal accountant is now a financial partner who helps improve your overall business strategy. They help you make smart decisions to reach your goals.

The Rise of the Strategic Advisor

When you're looking for an accountant, understanding how the industry is changing is essential. Technology and changing client needs have reshaped the traditional accountant's role. For instance, accounting firms are expected to heavily invest in AI and automation, with a projected CAGR of 42.5% through 2027.

This use of technology creates greater efficiency and strengthens areas like fraud detection and financial reporting. As the industry changes, the focus is on accountants who offer both technical skills and advisory services. This makes them incredibly valuable to businesses that need strategic advice in today's economy. Learn more about accounting industry trends here: Industry Trends. Also, understanding project management can be helpful when working with accounting professionals.

Key Skills to Look For in a Modern Accountant

This shift requires a new skillset for accounting professionals. Balancing the books isn't enough anymore. A modern accountant needs to be skilled in:

- Financial Analysis: This involves understanding financial data to spot trends and provide useful advice.

- Technological Fluency: This means using cloud-based accounting software like Xero or QuickBooks Online and other digital tools.

- Strategic Thinking: This involves creating financial plans that align with your business goals.

- Communication Skills: This means clearly explaining complex financial information to people who aren't financial experts.

Why This Matters for Your Business

Finding an accountant with these skills isn't a nice-to-have anymore—it's a must-have. These professionals offer more than just keeping you compliant with regulations; they can help your business succeed. They become key members of your team, offering strategic financial guidance that can boost growth and profits.

This lets you focus on other important parts of your business, knowing your finances are in capable hands. Finding the right accountant can be a major factor in the long-term success of your business.

Defining Your Financial Partnership Needs

Finding the right accountant is crucial for your business's success. Think of it like assembling a skilled team: you wouldn't ask a marketing expert to manage your finances. Just as different roles require specific expertise, different financial situations demand specific accounting skills. This section provides a practical guide to pinpoint exactly the financial support your business needs.

Understanding Your Business Needs

Start by evaluating your business's complexity. A solo entrepreneur will have different needs than a large corporation. Next, consider your specific industry. E-commerce businesses, for example, have unique online sales tax implications. Finally, factor in your future plans. Are you anticipating significant growth? This will directly influence the type of financial guidance you'll need in the long term.

Different Types of Accountants

Just as there are various specialized roles within a company, there are different types of financial professionals. Understanding these distinctions is essential for finding the right fit:

- Bookkeepers: Manage daily financial operations like recording income and expenses.

- CPAs (Certified Public Accountants): Provide a wider range of services, including auditing, tax preparation, and financial advising. Learn more about CPAs

- Tax Specialists: Concentrate on tax planning, preparation, and ensuring compliance.

- Financial Advisors: Offer guidance on long-term financial planning and investment strategies.

Choosing the right mix of skills depends on your business's specific requirements. A new startup might only need a bookkeeper initially, while a growing company could require a CPA and a dedicated tax specialist.

To help you navigate the different types of accounting professionals and their specializations, we've compiled the following table:

Accounting Professional Types: Finding Your Perfect Match

This table breaks down the different types of financial professionals, their qualifications, services, ideal business scenarios, and investment ranges.

| Professional Type | Qualifications | Core Services | Best For | Typical Cost Range |

|---|---|---|---|---|

| Bookkeeper | Associate's Degree or Certification | Recording transactions, managing accounts payable/receivable, basic financial reports | Small businesses, freelancers, startups | $20-$50/hour or $500-$2000/month |

| CPA | Bachelor's Degree, CPA Exam, State License | Auditing, tax preparation, financial advising, consulting | Businesses of all sizes, individuals | $150-$400/hour |

| Tax Specialist | Enrolled Agent (EA), CPA, or Tax Attorney | Tax planning, compliance, preparation, representation | Businesses with complex tax situations, individuals | $100-$300/hour |

| Financial Advisor | Certified Financial Planner (CFP), Chartered Financial Analyst (CFA) | Investment management, retirement planning, estate planning | Individuals, families, businesses | Varies depending on services and assets under management |

This table helps clarify the different roles and their typical costs, enabling you to make an informed decision. Remember, choosing the right financial professional is an investment in your business's future.

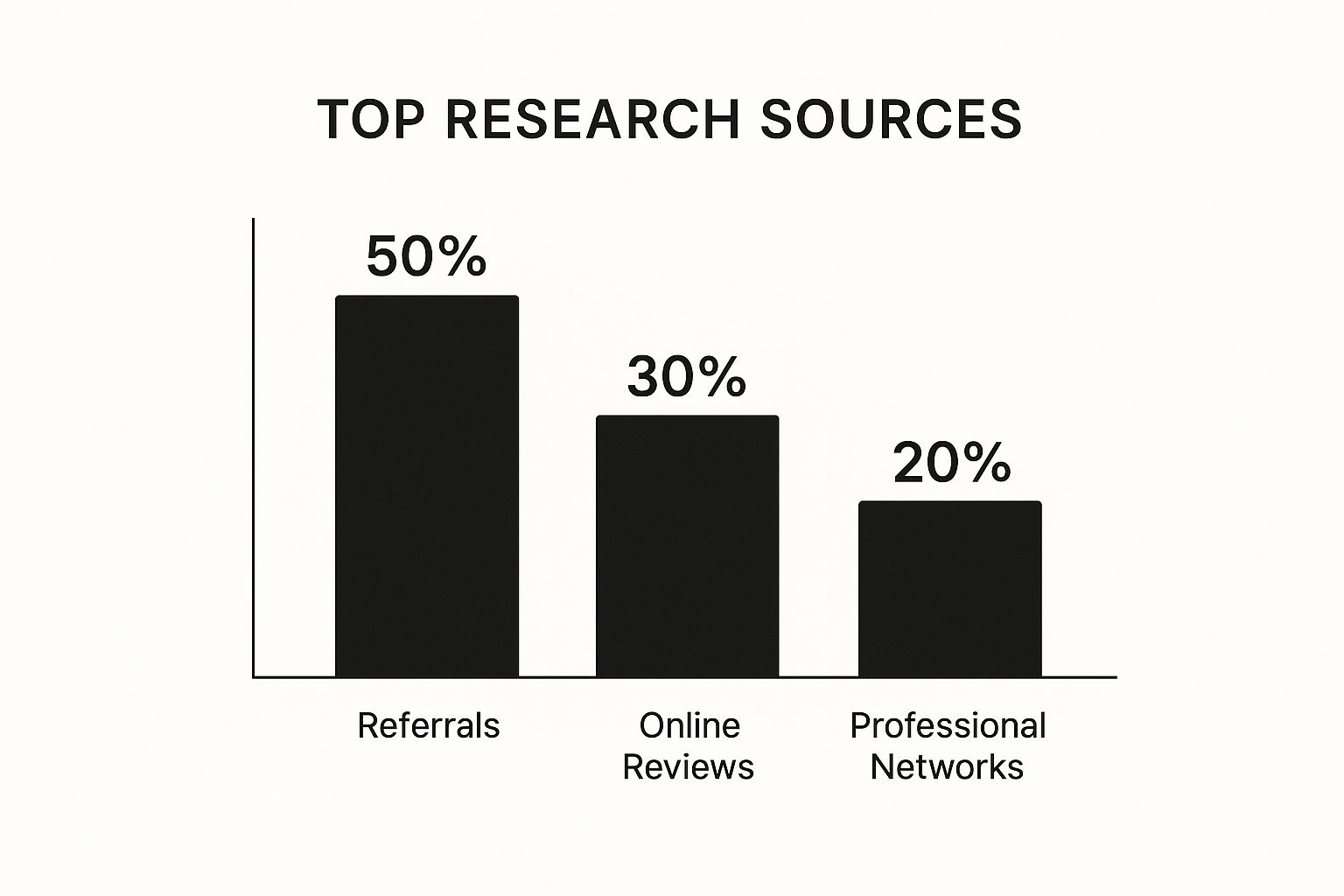

This chart illustrates how businesses typically find their accountants. The data shows that referrals account for 50% of the search process, followed by online reviews (30%) and professional networks (20%). This highlights the importance of word-of-mouth and a strong online presence for accountants.

The Importance of Clear Communication

Businesses with a clear understanding of their needs are better equipped to find the right accounting partner. This proactive approach prevents costly mismatches and fosters a productive working relationship. By clearly defining your requirements upfront, you create a targeted and efficient search process. It's like providing clear instructions for a project – it ensures everyone is on the same page.

Building Your Ideal Accountant Profile

By carefully considering your business’s complexity, industry, and future goals, you can develop a profile of your ideal accountant. Consider the necessary skills, experience, technological proficiency, and communication style. This clear vision simplifies your search process. Understanding your specific needs is the first step in finding an accountant who is the right fit, laying the foundation for a successful financial partnership.

Uncovering High-Value Accountant Sources

Finding the right accountant can be challenging. Knowing where to look can make the process much smoother. This section explores effective strategies for finding qualified accounting professionals, encompassing both traditional and online approaches.

Leveraging Your Network and Referrals

One of the best ways to find a trustworthy accountant is through referrals. Ask your professional network—colleagues, mentors, or business partners—for their recommendations. This offers valuable firsthand insights into an accountant's work ethic and client service.

Also consider reaching out to industry associations related to your business. These organizations often have directories or referral programs that can connect you with specialized accountants.

Exploring Digital Platforms and Online Reviews

Online platforms are changing how businesses find accountants. Websites dedicated to professional services like LinkedIn often showcase detailed profiles, client reviews, and accountant specializations. This lets you compare different accountants and find the right fit for your business needs.

It's important to thoroughly evaluate online reviews and consider multiple sources before making a decision. This careful research can lead to a more positive experience.

The Power of Professional Networks

Professional networking platforms, such as LinkedIn, are also valuable resources. You can search for accountants based on location, industry experience, and certifications. This provides a wide range of potential candidates to consider.

This broader reach is particularly useful for businesses seeking niche expertise or those looking outside their immediate area. The global accounting services market is growing rapidly, projected to reach $660.65 billion by 2025 with a 3% CAGR. This growth underscores the importance of selecting the right accountant. For more statistics, see the Global Accounting Services Market report.

Virtual Accounting Partnerships

Technology has made virtual accounting partnerships increasingly popular. This lets you access specialized expertise regardless of location. When considering your financial needs, remember to factor in the tax implications of different investment strategies. The Investment Tax Basics resource provides helpful information. This flexibility offers businesses more options than ever. For branding tips, see How to enhance your brand presence.

Evaluating Potential Candidates

No matter how you find potential accountants, thorough evaluation is essential. Check their credentials, review client testimonials, and schedule initial consultations. This helps you assess their communication style, understand their approach, and determine if their personality is a good fit for your business culture.

Asking specific questions about their experience with similar businesses and their familiarity with current accounting software can provide valuable insights. Careful consideration of these factors will help you choose an accountant who becomes a valuable asset to your business.

Assessing Technological Fluency in Accounting Partners

Finding a qualified accountant involves more than just checking credentials. Your accountant's comfort with technology plays a crucial role in your financial success. This means understanding how well a potential accountant uses technology in their daily practice. Their tech skills significantly impact your collaboration, data security, and strategic decision-making.

Why Cloud Accounting Expertise Matters

Cloud-based accounting is quickly becoming a necessity. It offers benefits like real-time data access and streamlined collaboration. This allows you to instantly view your financial position and easily share information with your accountant. This instant access allows for quicker decisions and better financial control.

Cloud accounting platforms often include robust security measures to protect sensitive financial data. These platforms employ advanced encryption and data backup systems, keeping your data safe and accessible. This offers peace of mind compared to traditional, potentially less secure methods.

When considering tech fluency, understanding emerging trends like predictive analytics in banking offers valuable insights into the future of finance. This forward-thinking approach helps you choose an accountant ready for the industry's evolving needs.

Evaluating Tech Proficiency

Don't accept vague statements about tech skills. Ask targeted questions. What accounting software do they use proficiently? Do they utilize automation tools for tasks like invoicing or reporting? How well do their systems integrate with your existing business software? This integration is vital for smooth data flow and efficient workflows.

The accounting industry has shifted significantly toward cloud-based solutions due to their accessibility and real-time data insights. By 2023, the cloud accounting market was projected to reach 4.25 million users, and 67% of accountants prefer cloud accounting to enhance business success. Find more detailed statistics here. This highlights the importance of choosing a tech-savvy accountant.

The Benefits of a Tech-Forward Accountant

Businesses partnering with tech-savvy accountants gain a competitive advantage. They benefit from immediate insight into their financial performance, allowing quicker responses to market changes. Streamlined workflows free up time to focus on core business activities, improving overall efficiency. Imagine accessing key financial data anytime, anywhere, and making informed decisions based on current information.

Key Questions to Ask Potential Accountants

Here are some questions to gauge an accountant's technological fluency:

- Which accounting software platforms do you primarily use?

- Do you use automation tools for tasks like invoicing and reconciliation?

- Can your systems integrate with my current CRM, inventory management, or other business software?

- What's your experience with data analytics and reporting dashboards?

- How do you ensure the security and confidentiality of client data in a digital environment?

By evaluating your accountant's tech proficiency, you choose a partner who strengthens your business. This proactive approach will yield long-term benefits.

Mastering The Accountant Interview Process

Finding the right accountant is crucial for your business's success. The interview process is where you build that all-important partnership – or spot potential issues early on. This section provides a guide to effectively evaluate potential accountants, going beyond just checking their qualifications and rates.

Evaluating Beyond The Resume

Credentials are essential, of course. However, you also need to assess communication styles, problem-solving abilities, industry knowledge, and strategic thinking. A Certified Public Accountant (CPA) might have impressive qualifications, but a poor communication style can hinder a productive partnership.

Understanding their problem-solving approach offers valuable insights into their work style. Look for accountants who ask insightful questions about your business. This demonstrates genuine interest in your needs and their commitment to providing tailored solutions.

This proactive approach distinguishes a true financial partner from someone simply crunching numbers. Industry-specific knowledge is also a key factor to consider.

Asking The Right Questions

Scenario-based questions are invaluable for uncovering an accountant's true capabilities. Ask about their experience handling challenges similar to those your business faces. Their responses will reveal how they apply their knowledge in practical situations.

Don't just focus on technical answers. Pay attention to their communication style. Can they explain complex concepts clearly and concisely? This is essential for a strong working relationship.

To help you further, we've compiled a list of power questions to ask during your accountant interviews. The following table outlines these questions, explaining their significance and what to look for in ideal responses.

This table provides a strategic question framework to help you identify exceptional accountants. It reveals their approach, expertise, and how well they might fit with your business.

| Question | Why It Matters | Green Flags in Responses | Red Flags in Responses |

|---|---|---|---|

| "Describe a time you helped a client navigate a complex financial challenge." | Reveals problem-solving skills and real-world experience. | Clear explanation of the challenge, strategy used, and positive outcome. | Vague answers, inability to articulate the process, or focus on the problem, not the solution. |

| "How do you stay up-to-date with the latest accounting regulations and technology?" | Shows commitment to continuous learning and tech proficiency. | Mention of specific professional development activities, software proficiency, and industry publications. | Lack of awareness of recent changes or resistance to new technologies. |

| "What's your approach to client communication and reporting?" | Assesses communication style and reporting frequency. | Clear and concise explanation of communication methods and reporting schedule, emphasis on client needs. | Vague answers, infrequent reporting, or a one-size-fits-all approach to communication. |

| "How would you approach integrating your services with my existing business systems?" | Evaluates technological compatibility and integration experience. | Detailed explanation of the integration process, software compatibility, and data migration strategies. | Lack of familiarity with common business systems or resistance to integration. |

By using these questions, you can gain valuable insights into each candidate’s experience and approach. This allows for a more informed hiring decision.

The Importance of Chemistry and Trust

Technical skills are fundamental, but chemistry and trust form the bedrock of a successful accounting partnership. You need to feel comfortable sharing sensitive financial information and confident in their advice.

This means finding an accountant isn't solely about qualifications; it's about finding the right personality fit for your business culture. Comparing candidates objectively is the final step in selecting the ideal financial partner who meets your unique needs.

You might also be interested in how to master the hiring process for other creative professionals. By carefully assessing all these factors, you’ll be well on your way to establishing a beneficial, long-term partnership.

Decoding Accounting Fee Structures and Agreements

Finding the right accountant is like choosing a reliable business partner. A key part of this process is understanding their fee structure. Just like you'd research costs for website design, understanding accountant fees is essential. This section breaks down common pricing models and helps you create agreements that protect your interests.

Common Fee Structures in Accounting

Accountants utilize several different fee structures. Let's take a closer look at each one:

-

Hourly Billing: This is a straightforward approach where you pay for the accountant's time. It offers flexibility, but necessitates clear communication about expected hours.

-

Fixed Retainers: With a fixed retainer, you pay a set monthly fee covering a pre-defined set of services. This is great for budgeting, but requires a clear outline of what's included.

-

Value-Based Pricing: In this model, fees are tied to the value the accountant delivers, like increased profits or tax savings. While it rewards results, it requires clear metrics for measuring value.

-

Hybrid Models: Often a blend of hourly and fixed-fee arrangements, hybrid models provide both predictability and flexibility, tailored to your business needs.

Understanding Reasonable Compensation

What's a "reasonable" fee? Well, that depends. Several factors influence the cost of accounting services:

-

Service Complexity: Basic bookkeeping costs less than complex tax strategies. Specialized services generally come with a higher price tag.

-

Business Size: Larger businesses with more complex transactions usually have higher accounting fees than smaller ones.

-

Accountant's Experience: A Certified Public Accountant (CPA) with years of experience and specialized credentials will likely charge more than someone starting out.

-

Location: Just like other services, accounting fees can vary by location due to differences in cost of living and market rates.

Evaluating Value Beyond the Hourly Rate

Don't just fixate on the lowest hourly rate. A more experienced accountant might be more efficient, costing less overall. Their insights could also lead to significant long-term savings.

The Importance of a Comprehensive Service Agreement

A well-defined service agreement is crucial. It should clearly outline the following:

-

Scope of Services: Detail exactly what services are included, such as bookkeeping, tax preparation, financial reporting, and payroll.

-

Fee Structure: Explain the chosen pricing model, including hourly rates, retainer amounts, or the calculation method for value-based pricing.

-

Payment Terms: Clearly state payment schedules, due dates, and accepted methods.

-

Responsibilities: Outline both your and the accountant's responsibilities regarding information sharing and communication.

-

Termination Clause: Establish how either party can terminate the agreement.

Negotiating these details upfront prevents misunderstandings and fosters a strong, productive, and long-term relationship. By understanding accountant fees and agreements, you can confidently choose an accountant offering great service at a fair price.

Cultivating a Transformative Accounting Partnership

Finding the right accountant is just the first step. The true benefit comes from nurturing a strong, ongoing relationship. This section explores maximizing your accounting partnership through clear communication, aligned expectations, and strategic collaboration.

Building Effective Communication Systems

Open and consistent communication is the cornerstone of any successful accounting partnership. Think of your finances like a well-oiled machine: every part needs to work together seamlessly. Establishing clear communication channels, whether regular meetings, email updates, or a shared online platform like Google Workspace, ensures everyone stays informed and can address potential issues proactively.

For example, schedule a monthly meeting to review financial reports, discuss upcoming plans, and address any concerns. This consistent dialogue fosters a proactive approach to financial management. Additionally, using a shared online document system provides easy access to important files, improving efficiency and collaboration.

Aligning Expectations and Goals

Just as a sports team needs a shared game plan, you and your accountant must be aligned on goals. Clearly define your business objectives and what you expect from the partnership. This shared understanding forms the bedrock of a productive and mutually beneficial relationship.

Discuss both your short-term and long-term goals. Is expansion on the horizon? Are you primarily focused on minimizing tax liabilities? Sharing these objectives informs your accountant's strategies and ensures they align with your vision.

Strategic Collaboration for Growth

The most valuable accounting partnerships go beyond basic bookkeeping and become strategic alliances. Your accountant shouldn't just manage your finances; they should actively contribute to your business growth. This involves regular discussions about financial strategy, performance evaluation, and potential areas for improvement.

Regularly assess your financial processes. Are there opportunities to streamline operations or boost efficiency? Your accountant can offer valuable insights and recommendations based on their expertise. This collaborative approach can uncover cost savings or new avenues for increased profitability. For example, implementing accounting software like QuickBooks or Xero might streamline operations and improve financial reporting.

Overcoming Challenges and Maintaining Momentum

Even the strongest partnerships face occasional hurdles. Address any disagreements or communication breakdowns promptly and professionally. Open communication is crucial for resolving conflicts and maintaining a healthy working relationship. For more insight into building strong professional relationships, see our guide on Innovative Talent Acquisition Strategies.

Regularly evaluate the partnership. Is your accountant meeting your expectations? Are they providing the level of support and strategic guidance you need? Ongoing assessment ensures a productive and mutually beneficial relationship, guaranteeing your accounting partnership continues adding value as your business evolves.

Building a Lasting Partnership

Choosing an accountant isn't a one-time task; it’s about cultivating a long-term relationship. By prioritizing clear communication, shared goals, and strategic collaboration, you transform a simple accounting service into a valuable asset that drives your business's success. This ensures your financial partner remains a key player in your ongoing business journey.

Are you ready to connect with top-tier creative professionals who can elevate your business? Visit Creativize today to discover a network of talented individuals ready to contribute to your success.