A well-crafted business portfolio is more than just a list of assets; it's a strategic roadmap that guides resource allocation, mitigates risk, and fuels sustainable growth. Whether you're a startup exploring expansion or a multinational conglomerate optimizing operations, understanding different portfolio models is crucial for success. Simply listing your products or services isn't enough to build a resilient, forward-thinking enterprise. Effective portfolio management requires a deep understanding of how each component contributes to the whole, ensuring your business is balanced, competitive, and positioned for long-term viability.

This guide moves beyond theory to dissect 8 diverse business portfolio examples, from classic frameworks like the BCG Matrix to modern strategies like platform ecosystems and value chain integration. We will break down the strategic thinking behind each model, offering actionable takeaways you can apply directly. Understanding how these distinct portfolio structures work is the first step; aligning them with functional tactics is the next. For instance, to understand how specific functional strategies contribute to overall business transformation, an ultimate guide to marketing automation strategy can provide valuable insights into operational efficiency. By exploring these real-world examples, you'll gain the strategic clarity needed to build your own high-performing portfolio.

1. Boston Consulting Group (BCG) Growth-Share Matrix Portfolio

The Boston Consulting Group (BCG) Growth-Share Matrix is less a visual portfolio and more a powerful strategic framework. It's one of the most enduring business portfolio examples because it provides a clear, data-driven method for analyzing a company's products or business units. The matrix plots these units on a four-quadrant grid based on two key variables: market growth rate and relative market share.

This classification system helps leaders make informed decisions about where to invest, divest, or maintain their position.

Strategic Breakdown and Analysis

The genius of the BCG Matrix lies in its simplicity and direct link to resource allocation. Each quadrant suggests a specific strategic action:

- Stars (High Growth, High Share): These are market leaders in high-growth industries. They require significant investment to fuel their growth and fend off competition. Example: Samsung’s Galaxy smartphone line during its peak growth years.

- Cash Cows (Low Growth, High Share): Dominant players in mature markets. They generate more cash than they consume and are used to fund Stars and Question Marks. Example: Procter & Gamble’s Tide laundry detergent.

- Question Marks (High Growth, Low Share): These units are in attractive, fast-growing markets but don't yet have a strong market share. They require careful analysis to determine if they can become Stars with investment or should be divested. Example: Disney's early investments in its streaming service, Disney+.

- Dogs (Low Growth, Low Share): These units have a weak market position in a low-growth industry. They typically generate low profits or losses and are often candidates for divestiture.

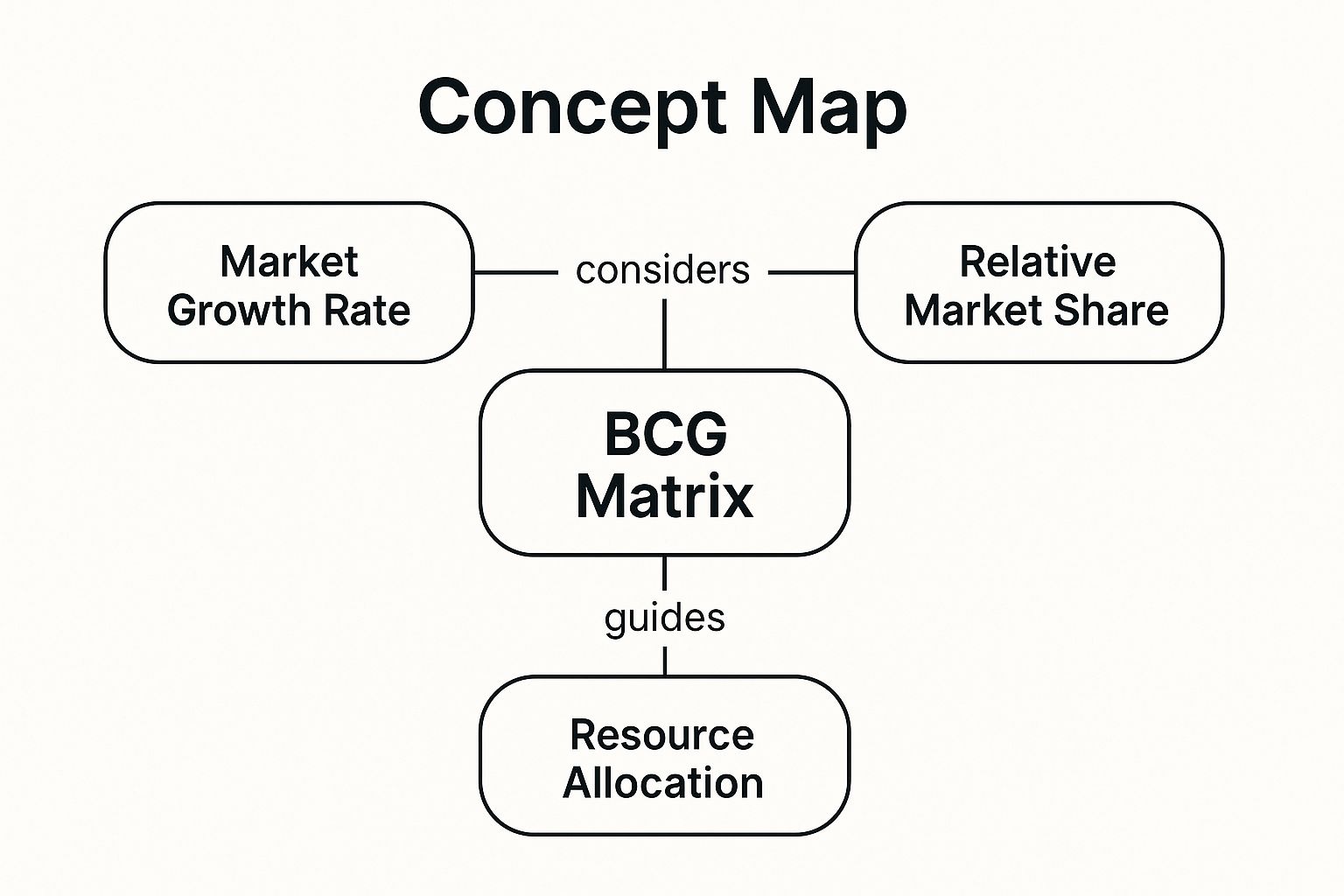

This infographic shows the core components that drive the BCG Matrix framework.

The visualization highlights how market dynamics and competitive position are the foundational inputs for strategic resource allocation decisions.

Actionable Takeaways

To apply this model, start by gathering accurate data on market growth rates for your industries and the relative market share of each product or business unit.

Key Takeaway: The BCG Matrix is not a one-time exercise. Markets evolve, and today's Star could be tomorrow's Cash Cow. Regularly update your matrix to reflect current market realities and adjust your strategies accordingly.

This framework serves as an excellent starting point for deeper strategic conversations. For a comprehensive look at optimizing your business assets, you can explore various portfolio optimization techniques that build upon this foundational model.

2. GE-McKinsey Nine-Box Matrix Portfolio

The GE-McKinsey Nine-Box Matrix is a sophisticated strategic planning tool developed as an advancement over the simpler BCG Matrix. It stands out as one of the more nuanced business portfolio examples, evaluating a company's business units on two composite dimensions: industry attractiveness and competitive strength. Instead of four quadrants, it uses a nine-box grid, offering a more granular view for strategic decisions.

This multi-factor approach allows leaders to move beyond just market share and growth, incorporating a wider range of internal and external variables to guide investment, hold, or divestment choices.

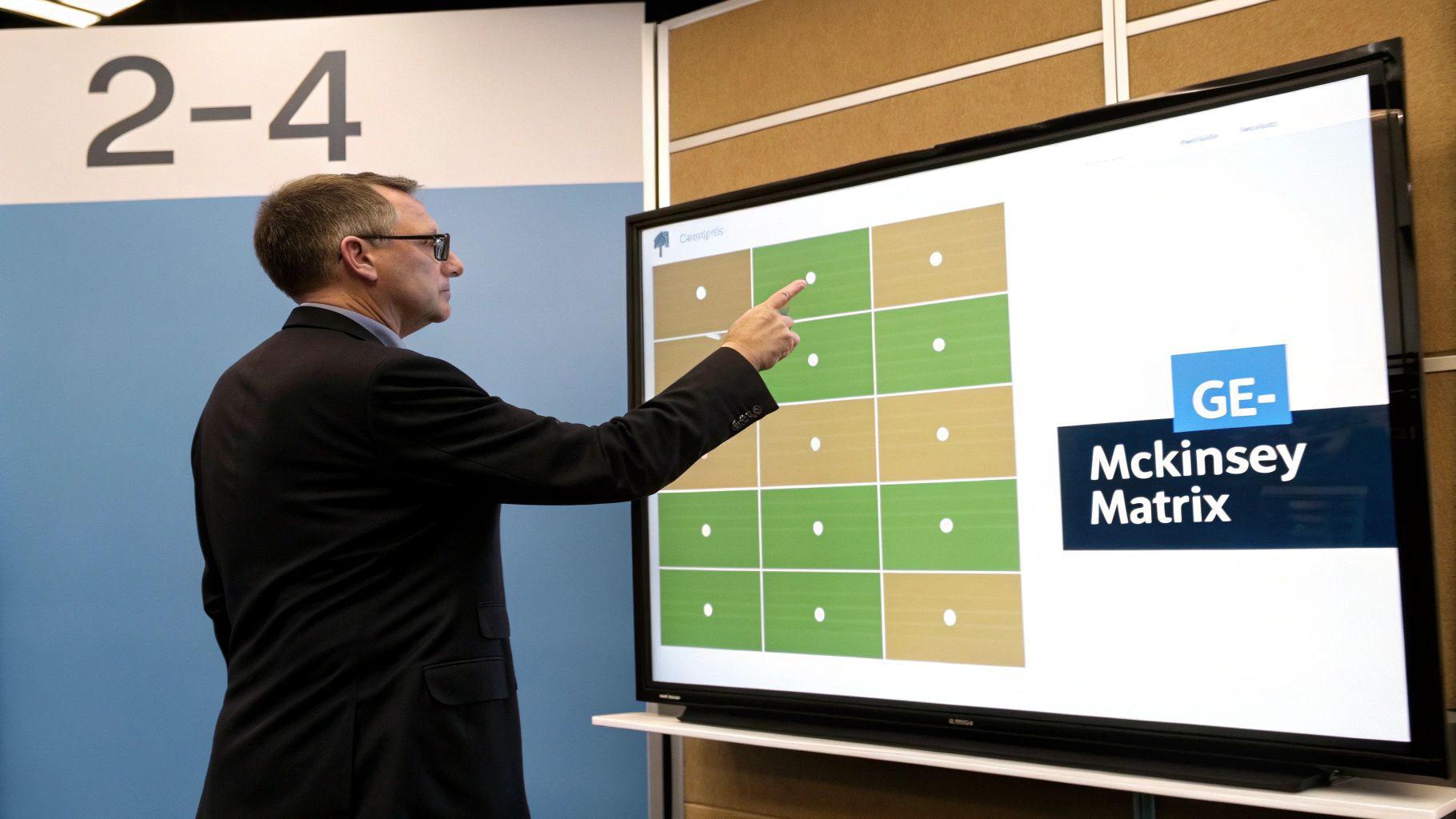

The visualization shows how different strategic postures, from aggressive investment to selective harvesting, are recommended based on a unit's position within the nine-box grid.

Strategic Breakdown and Analysis

The power of the GE-McKinsey Matrix lies in its flexibility and depth. The two axes are determined by multiple, weighted factors customized to the company's specific context, providing a more robust analysis.

- Invest/Grow (High Attractiveness, High Strength): Units in these top-left boxes are prime candidates for aggressive investment and growth. They are in attractive industries where the company has a strong competitive position. Example: 3M’s investment in its high-performing healthcare and consumer goods divisions.

- Selectivity/Earn (Medium Attractiveness/Strength): The diagonal boxes represent units requiring a more cautious approach. Investment should be selective, aimed at maintaining position or capitalizing on specific opportunities. Example: Unilever carefully managing established but slower-growing food brands.

- Harvest/Divest (Low Attractiveness, Low Strength): Units in the bottom-right are in unattractive industries with a weak business position. The recommended strategy is often to harvest remaining cash flow or divest them. Example: General Electric’s divestiture of its GE Capital assets to refocus on its industrial core.

Actionable Takeaways

To use this model effectively, a company must first define and weight the specific factors that constitute "industry attractiveness" (e.g., market size, growth rate, profitability) and "competitive strength" (e.g., brand equity, market share, technological advantage) for its unique situation.

Key Takeaway: The GE-McKinsey Matrix's strength is its customizability, but this is also a challenge. Involve a cross-functional team to define and weight criteria to reduce bias and ensure a holistic, objective assessment of each business unit.

This framework is ideal for diversified corporations needing a more sophisticated tool for resource allocation. To dive deeper into such strategic frameworks, you might explore various business portfolio management strategies that expand on these core principles.

3. Conglomerate Portfolio Model

A conglomerate portfolio consists of multiple, often unrelated, business units operating in different industries under a single corporate parent. This model is one of the classic business portfolio examples, focusing primarily on financial performance and risk diversification rather than operational synergy between its units. The parent holding company provides capital allocation, strategic oversight, and sometimes shared administrative services.

This approach allows a corporation to spread investment risk across various sectors, theoretically protecting it from a downturn in any single industry.

The visualization shows how a central entity can manage a wide array of non-synergistic businesses, focusing on their individual financial health and contribution to the overall portfolio.

Strategic Breakdown and Analysis

The power of the conglomerate model lies in its disciplined approach to capital allocation and its ability to act as an internal capital market, moving funds from high-cash-flow businesses to those with high-growth potential.

- Diversification and Risk Management: By operating in disconnected industries, the portfolio is insulated from sector-specific shocks. Example: Berkshire Hathaway's portfolio includes insurance (GEICO), utilities (BNSF Railway), and retail (See's Candies), which have very different economic cycles.

- Efficient Capital Allocation: The corporate parent can allocate capital more efficiently than external markets, funding promising internal ventures that might struggle to get traditional financing.

- Managerial Oversight: The parent company provides a layer of strategic governance and financial discipline that can improve the performance of individual business units. Example: General Electric, under Jack Welch, famously insisted that every business be #1 or #2 in its market.

- Focus on Financial Performance: Success is measured by financial returns, allowing for objective decisions about acquiring, holding, or divesting businesses based on their performance and future prospects.

Actionable Takeaways

To successfully manage a conglomerate portfolio, the central leadership must excel at financial analysis and strategic capital deployment. Effective marketing budget planning for each distinct unit becomes crucial, as each operates in its own unique market.

Key Takeaway: The conglomerate model's success hinges on the parent company's ability to add value beyond what the business units could achieve independently. This value comes from superior capital allocation, strategic guidance, and instilling strong financial discipline.

4. Platform Portfolio Strategy

A platform portfolio strategy centers on building a core, foundational business platform that enables the creation and support of multiple related products, services, and market extensions. This is one of the most powerful business portfolio examples for modern digital companies, as it leverages a central technology or ecosystem to achieve economies of scope and scale. Instead of managing disparate units, the company builds a portfolio where each part reinforces the others.

This strategy creates a flywheel effect, where the core platform's strength attracts more users and developers, which in turn enhances the value of every product and service built upon it.

Strategic Breakdown and Analysis

The platform approach shifts the focus from individual product performance to the health and growth of the entire ecosystem. It treats the core platform as the primary asset, with other business units acting as applications of that asset.

- Core Platform (The Foundation): The central technology, infrastructure, or marketplace that creates value. Example: Amazon Web Services (AWS) provides the cloud infrastructure that powers not only Amazon's retail and logistics operations but also thousands of other businesses.

- Adjacent Businesses (The Extensions): Products and services built on top of or connected to the platform. They leverage the platform's user base, data, or capabilities. Example: Apple’s App Store, Apple Music, and iCloud are all extensions built on the iOS platform.

- Ecosystem Partners (The Network Effect): Third-party developers, creators, or sellers who build on the platform, adding value and attracting more users. Example: Salesforce's AppExchange, a marketplace for third-party apps that extend the core CRM functionality.

- Strategic Coherence: Each part of the portfolio is strategically aligned with strengthening the platform, creating a defensible competitive moat that is difficult for competitors to replicate.

Actionable Takeaways

To implement a platform strategy, a business must invest heavily in creating a scalable, flexible, and reliable core. This requires strong governance to ensure that all extensions adhere to platform standards.

Key Takeaway: Success with a platform portfolio hinges on fostering strong network effects. Your primary goal is not just to build products but to cultivate a thriving ecosystem where the value for each user increases as more users join.

Managing the development and integration of these extensions demands robust oversight. Explore different approaches to creative project management to ensure your platform and its adjacent businesses evolve in a coordinated and effective manner.

5. Core-Satellite Portfolio Approach

The Core-Satellite model is a powerful strategic framework adapted from investment management for corporate strategy. It's one of the most dynamic business portfolio examples because it structures a company around a stable, foundational 'core' business and several smaller, more innovative 'satellite' ventures. The core provides consistent revenue and stability, while the satellites explore new markets and technologies.

This balanced approach allows an organization to protect its primary revenue streams while systematically pursuing high-growth, innovative opportunities without destabilizing the entire enterprise.

Strategic Breakdown and Analysis

The strength of the Core-Satellite approach is its ability to manage risk while fostering innovation. It formalizes a dual focus: efficiently managing the present (core) while strategically building the future (satellites).

- Core Business (Stable, High Share): This is the established, profitable center of the company. It's typically a market leader with a strong brand and reliable cash flow. The strategic focus here is on optimization, incremental innovation, and defending market position. Example: Google's search and advertising business, which acts as the financial engine for Alphabet.

- Satellite Ventures (High Growth, Experimental): These are smaller, often high-risk ventures operating in emerging markets or new technologies. They are funded by the core and have the potential to become the next core business. Their goal is learning, exploration, and disruptive growth. Example: Alphabet's Waymo (autonomous vehicles) or Verily (life sciences).

- Resource Allocation: The core business generates the capital necessary to fund the more speculative satellite projects. This creates a self-sustaining innovation pipeline, where the success of the present directly enables the exploration of the future.

- Performance Metrics: The core is measured on profitability and efficiency, while satellites are evaluated based on milestones, learning, and long-term growth potential.

This model provides a clear structure for managing different types of business units with distinct goals and timelines.

Actionable Takeaways

To implement this model, clearly define the criteria that separate your core business from potential satellites. Establish distinct governance models and performance metrics for each category to ensure clarity and focus.

Key Takeaway: The biggest risk in a Core-Satellite model is neglecting the core. The core business must continue to innovate and receive adequate investment to remain competitive, as it funds the entire portfolio's future growth.

Effectively managing these distinct operational demands is a challenge. For insights on managing both stable and experimental business units, you can review best practices in creative operations management, which helps balance efficiency with innovation.

6. Value Chain Integration Portfolio

A value chain integration portfolio is a strategic model where a company owns multiple stages of its production and distribution process. Rather than being just one of many business portfolio examples, this represents a deep commitment to vertical integration, covering everything from raw material sourcing to final customer delivery. The goal is to gain control, reduce costs, and capture more value across the entire chain.

This approach creates a tightly controlled ecosystem, minimizing reliance on external suppliers and distributors while maximizing operational efficiency and quality assurance.

Strategic Breakdown and Analysis

The power of this model lies in its ability to create a seamless, efficient, and highly responsive business operation. By integrating key activities, a company can build significant competitive advantages.

- Upstream Integration: This involves controlling the supply side of the business. Owning suppliers or production facilities ensures a stable and quality-controlled source of raw materials or components. Example: Tesla’s Gigafactories produce batteries in-house, securing a critical component for its electric vehicles.

- Core Operations Integration: This focuses on bringing key production or service delivery processes under one roof. It allows for rapid innovation and quality control. Example: Zara/Inditex designs, manufactures, and distributes its apparel, enabling its famous "fast fashion" model.

- Downstream Integration: This involves managing the distribution and sales channels. It provides direct access to customers, allowing for better brand control and data collection. Example: Starbucks sources, roasts, and sells its coffee directly to consumers through its company-owned stores.

This integrated portfolio allows businesses like Netflix to control both content creation (production studios) and distribution (streaming platform), creating a powerful, self-reinforcing cycle of value.

Actionable Takeaways

Implementing a value chain integration strategy requires significant capital and operational expertise. Start by identifying the most critical and value-creating stages of your chain.

Key Takeaway: Full integration isn't always necessary or wise. Continuously perform a "make-versus-buy" analysis for each stage of the value chain to ensure your integrated operations remain more efficient and cost-effective than outsourcing.

Consider partial integration or strategic partnerships as less capital-intensive alternatives to gain control over vital parts of your business process.

7. Geographic Diversification Portfolio

A geographic diversification portfolio is not a single document but a strategic approach to business structure. It's one of the most effective business portfolio examples for building resilience, as it involves spreading operations across multiple countries or regions. This strategy insulates a company from localized economic downturns, political instability, or market saturation in its home country.

By entering new markets, a business can tap into new growth opportunities, access diverse talent pools, and leverage global economies of scale.

Strategic Breakdown and Analysis

The power of geographic diversification lies in its ability to balance risk and unlock new revenue streams. The strategy is built on several key operational pillars:

- Market Entry Strategy: Companies must decide how to enter a new region. This could involve direct investment (building from scratch), joint ventures with local partners, or acquiring an existing local company. Example: Unilever’s expansion into emerging markets often involves acquiring established local brands.

- Product/Service Adaptation: A one-size-fits-all approach rarely works. Successful companies adapt their offerings to meet local tastes, cultural norms, and regulations. Example: McDonald’s offers items like the McSpicy Paneer in India and the Teriyaki McBurger in Japan.

- Supply Chain Localization: Building regional supply chains reduces logistical costs, mitigates risks from global disruptions, and can improve speed to market. Example: IKEA sources materials and manufactures products in various regions to serve nearby markets efficiently.

- Global Brand, Local Feel: The core brand identity remains consistent, but marketing and operations are tailored to resonate with local customers. Example: Coca-Cola maintains its global branding while managing localized distribution networks and marketing campaigns.

Actionable Takeaways

To implement a geographic diversification strategy, begin by researching markets with cultural or economic similarities to your own. This eases the transition and reduces initial risks.

Key Takeaway: True geographic diversification requires a flexible business model. Invest heavily in local market research and empower regional leadership to make decisions that align with local customer needs, rather than imposing a rigid, centralized approach.

This portfolio strategy is a long-term play that demands significant investment in understanding new cultures and business environments. To explore how to finance such an expansion, it's useful to understand different types of business investment that can support international growth.

8. Innovation-Driven Portfolio

An innovation-driven portfolio organizes its business units and investments around research, development, and the pursuit of breakthrough technologies. This is one of the more forward-looking business portfolio examples, as its core principle is creating future value rather than just managing existing assets. It involves balancing projects across different stages, from foundational research to market-ready products.

This approach aims to build a sustainable competitive advantage by establishing leadership in technology and continuous improvement.

Strategic Breakdown and Analysis

The strength of an innovation-driven portfolio lies in its structured approach to managing uncertainty and fostering growth. It typically involves a pipeline of projects, categorized to balance risk and potential returns:

- Core Innovations: These are incremental improvements to existing products and markets. They provide steady, predictable returns and fund more ambitious projects. Example: Samsung’s yearly enhancements to its existing semiconductor technology.

- Adjacent Innovations: This involves leveraging existing capabilities to enter new markets or create new products for existing customers. Example: 3M applying its expertise in adhesives to create new products for the healthcare industry.

- Transformational Innovations: These are breakthrough inventions that create entirely new markets or disrupt existing ones. They are high-risk but offer the highest potential reward. Example: Johnson & Johnson's development of groundbreaking pharmaceuticals through its R&D pipeline.

- Pacing and Basic Research: This category includes long-term projects and fundamental scientific exploration that may not have immediate commercial application but can lead to future breakthroughs.

This framework ensures that the company is not just optimizing for today but is actively building the business of tomorrow.

Actionable Takeaways

To implement an innovation-driven portfolio, businesses must create a culture that supports experimentation and accepts intelligent failure. Start by mapping your current projects across core, adjacent, and transformational categories to identify gaps.

Key Takeaway: Success with this model requires more than just R&D funding; it demands a robust process for evaluating, advancing, and terminating projects. A disciplined stage-gate process is critical for managing the innovation pipeline effectively.

Building this type of portfolio also depends on attracting the right people. You can explore innovative talent acquisition strategies to find and hire individuals who thrive in a creative, forward-thinking environment.

8 Business Portfolio Models Comparison

| Portfolio Model | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| BCG Growth-Share Matrix | Low to moderate; simple four-quadrant analysis | Moderate; requires reliable market data | Visual classification of units by growth and market share | Large corporations with multiple business units | Simple, clear resource allocation guidance |

| GE-McKinsey Nine-Box Matrix | High; multi-factor, weighted scoring system | High; extensive data collection and analysis | Nuanced strategic recommendations with competitive insights | Complex, diversified corporations | More comprehensive and customizable than BCG |

| Conglomerate Portfolio Model | Moderate; decentralized management structure | High; capital allocation and governance needed | Risk diversification via unrelated industries | Holding companies managing unrelated businesses | Risk reduction, financial stability across sectors |

| Platform Portfolio Strategy | High; requires platform development & ecosystem mgmt | Very high; significant upfront investment | Synergies, economies of scope, and scalable market expansion | Tech companies building ecosystems | Strong network effects and competitive moats |

| Core-Satellite Portfolio Approach | Moderate; balancing core stability & satellite risk | Moderate; varied by core and satellite scale | Balanced risk with innovation and growth opportunities | Firms seeking risk-adjusted growth | Combines stability with flexibility and innovation |

| Value Chain Integration Portfolio | High; vertical integration across multiple stages | Very high; capital and operational resources | Greater value capture and operational control | Companies focused on vertical control and margins | Control over quality, costs, and supply chain |

| Geographic Diversification Portfolio | High; managing across multiple regions and markets | High; investment in local adaptation and presence | Risk reduction from geographic spread and multiple growth pockets | Multinationals expanding globally | Reduces regional risks; access to diverse markets |

| Innovation-Driven Portfolio | High; managing multiple R&D projects | Very high; heavy investment in innovation | Sustainable advantage via technological leadership | Tech and R&D intensive industries | Drives breakthrough products and technology leadership |

From Theory to Action: Building Your Winning Portfolio

We've journeyed through a comprehensive collection of business portfolio examples, from the classic BCG Growth-Share Matrix to the dynamic Innovation-Driven model. The strategic thread connecting them all is clear: a well-crafted portfolio is not a static document but a dynamic roadmap for sustainable growth, risk management, and market leadership. The most powerful lesson is that the "perfect" model is the one that aligns with your specific industry, competitive landscape, and organizational vision.

The true masters of strategy, as we've seen, often hybridize these approaches. They might use a Core-Satellite structure to protect their primary revenue streams while simultaneously deploying an Innovation-Driven model to explore new frontiers, much like Alphabet does. This blended strategy allows for both stability and disruptive potential, creating a resilient and forward-thinking enterprise. Your goal should be to move beyond simply adopting a single framework and instead, creatively combine elements that serve your unique strategic objectives.

Translating Insight into Actionable Strategy

Understanding these models is the first step; applying them is where real value is created. To begin architecting your own winning portfolio, follow these critical steps:

- Conduct a Rigorous Internal Audit: Start by mapping out your current business units, products, or service lines. Assess each one against key metrics like market share, growth rate, profitability, and resource consumption. This provides the foundational data needed for strategic analysis.

- Define Your Strategic North Star: What is your ultimate goal? Are you aiming for market domination, rapid innovation, stable cash flow, or geographic expansion? Your long-term vision will dictate which portfolio model, or combination of models, is the most suitable framework for your decisions.

- Align and Allocate Resources: Once you've categorized your business units using a model like the BCG or GE-McKinsey matrix, you can make informed decisions about resource allocation. This means strategically investing in your "Stars," managing your "Cash Cows" for maximum return, and deciding the fate of your "Question Marks" and "Dogs."

Executing Your Vision with Precision

Executing a new portfolio strategy is a complex undertaking that requires specialized expertise and dedicated effort across various functions. For instance, if your portfolio includes launching new products or entering new markets, a robust affiliate marketing channel can be a powerful growth lever. The successful implementation of a business portfolio strategy often involves specialized roles and dedicated efforts; delve deeper into the responsibilities of an affiliate program manager to understand how such a role can drive performance for key business units within your portfolio. This level of tactical execution is what separates a theoretical plan from tangible business results. By ensuring you have the right talent in place to manage each component of your strategy, you turn your portfolio from a diagram into a high-performance engine for growth.

Ready to bring your strategic vision to life with stunning visuals and compelling brand stories? The most brilliant portfolio strategy needs world-class creative execution to connect with your audience. Creativize is a talent marketplace designed to connect you with elite creative professionals, from branding experts to animators, who can help you build and market every part of your business portfolio with impact and flair.